Early reactions to end of Illinois budget deadlock are mixed

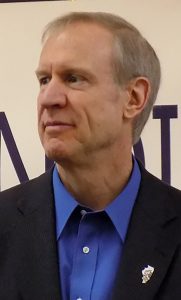

By Jean Lotus Staff reporter — July 9, 2017The Illinois General Assembly lurched into a budget breakthrough July 6 when the House voted to 71-42 (with five members not voting) to override Gov. Bruce Rauner’s vetoes of a 32 percent income tax increase bill.

The House then overruled a veto on a $36.5 billion spending bill veto and a $6 billion bond to pay backlogged debts, ending two years of partisan stalemate that devastated Illinois social services and brought public universities to their knees.

The session started with a two-hour Capitol building lockdown, after a protesting woman tossed an unidentified white powder into the governor’s offices. Emergency personnel in full-body hazmat suits collected the powder. The woman was taken into custody by Springfield police.

The tax hike bill has split lawmakers along party lines.

Effective July 1, the Illinois flat personal income tax rate will bump up to 4.95 percent, up from 3.75 percent, and corporate tax rate hike up to 7 percent from 5.25 percent. A statement from Rauner called the override of his veto, “another step in Illinois’ never-ending tragic trail of tax hikes. Speaker Madigan’s 32 percent permanent income tax increase will force another tax hike in the near future,” Rauner warned. Rauner’s own Feb. 15 budget proposal included almost identical income tax hikes to 4.99 percent, but they were offset by a four-year property tax freeze.

“This balanced budget reflects two realities we face in Springfield: the fiscal reality of a state mired in debt and teetering on the brink of collapse after two years without a financial plan, and the political reality of what lawmakers were able to negotiate and pass,” said Sen. Andy Manar (D-Bunker Hill) in a statement. “It’s not perfect, and we have more work to do. That includes negotiating additional reforms to save money for taxpayers.”

More than a dozen Republican House members voted for a third reading of the tax bill on July 2, with the overhanging threat of a credit rating downgrade by bond rating agencies. But when it came to actually overriding the governor’s veto, the bill passed with the minimum three-fifths majority.

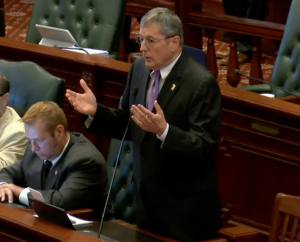

“There is no joy here. There’s no joy in voting for a gubernatorial veto and a tax increase,” said David Harris (R-Arlington Heights), who voted for the override. “But how long can this impasse go on? We are looking into a financial abyss and the state is imploding.”

Republicans who switched their vote Thursday against the override included Charlie Meier (R-Okawville), who voted yes on the tax hike bill for the earlier “third reading,” but then changed his vote. Meier’s 108th District covers parts of Madison County.

“I listened to my constituents and voted against the permanent income tax hike,” Meier wrote on his website. “The people I spoke with want to see more reforms and cuts before any talk of increasing taxes. I voted against the tax hike since zero reforms came back from the Senate. I supported the Governor’s veto and the taxpayers’ wishes.”

Meier got lots of negative responses on Facebook after his July 2 vote, which he explained on his website: “The truth is, this wasn’t easy, I realize a tax increase isn’t popular. However, this was the viable option to keep our state government from shutting down and putting lives at risk.”

House Rep. David Harris (R-Arlington Heights) voted “aye” during the July 6 special override vote. (Blueroomstream)

Other Republican House members who changed their vote from “yes” July 2 to “no” on the override included John Cavaletto (R-Salem), C.D. Davidsmeyer (R-Jacksonville) and David Reis (R-Ste. Marie).

Several Democrats also changed their vote from “no” on the third reading to “yes” for the veto override.

Rita Mayfield (D-Waukegan) of Lake County changed her vote from a “no” on the third reading, to vote “yes” on the veto override. Mayfield, a former Waukegan school official was not considered to be in a toss-up district, since she won the Nov. 2016 primary with 76.4 percent of the vote, defeating Republican Robert Ochsner who won 23.6 percent. Mayfield was appointed in 2010 to replace Democrat State Rep. Eddie Washington, who died of a heart attack.

Other Democrats who changed their votes from a “no” to a “yes” to pass the tax bill included Mike Halpin (D-Rock Island), Natalie Manley (D- Joliet) and Sue Scherer (D-Decatur).

Some Republicans raged against the vote, slipping into campaign rhetoric in advance of the 2018 elections. “A junk budget” was the expression used by Allen Skillcorn (R-East Dundee).

“Overriding the Governor’s vetoes today only stands to make problems worse for Illinoisans,” he said. “Moody’s has indicated this tax increase and budget do not adequately address Illinois’ financial problems, meaning this is a ‘junk budget.’ Nothing is being done to address our $15 billion in unpaid bills or deal with the more than $100 billion in unfunded pension liabilities. All that is accomplished by overriding the vetoes is to ensure that more families will be driven from their homes and our financial problems will grow even worse as our economic growth slows even more.”

“This budget is full of smoke and mirrors,” said David McSweeney (R-Barrington Hills). “This budget is not going to create fundamental reform. Our constituents will see their taxes rise by 32 percent and what will they get? Nothing.”

But hospitals and medical groups representing state vendors with $14 billion of overdue bills praised the budget progress.

“We thank legislators, on both sides of the aisle, who took very difficult votes to resolve the state’s budget impasse,” said A.J. Wilhelmi, president and CEO of the

Illinois Health and Hospital Assn. in a statement. “We appreciate that the General Assembly successfully worked for a comprehensive budget solution – including enhanced revenues – without damaging cuts to healthcare. A full state budget helps support healthcare as well as critical social services provided in communities across the state.”

— Early reactions to end of Illinois budget deadlock are mixed —