Illinois Congressional delegation: How they voted

Chronicle Media — October 24, 2017 10-Year Republican Budget: Voting 51 for and 49 against, the Senate on Oct. 19 adopted a 10-year budget blueprint (H Con Res 71) that would pave the way for later action on corporate and individual tax cuts increasing budget deficits by up to $1.5 trillion. The Senate version of the fiscal 2018 budget resolution also calls for cutting entitlement and discretionary spending by $5.8 trillion and sets ground rules that would allow the Senate to pass a tax-overhaul bill by a simple-majority vote. The measure also expedites action to open the Arctic National Wildlife Refuge to oil and gas drilling and end the deduction for state and local income taxes.

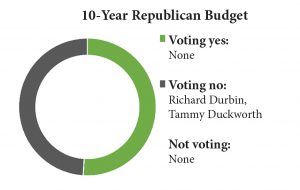

10-Year Republican Budget: Voting 51 for and 49 against, the Senate on Oct. 19 adopted a 10-year budget blueprint (H Con Res 71) that would pave the way for later action on corporate and individual tax cuts increasing budget deficits by up to $1.5 trillion. The Senate version of the fiscal 2018 budget resolution also calls for cutting entitlement and discretionary spending by $5.8 trillion and sets ground rules that would allow the Senate to pass a tax-overhaul bill by a simple-majority vote. The measure also expedites action to open the Arctic National Wildlife Refuge to oil and gas drilling and end the deduction for state and local income taxes.

The largely non-binding fiscal plan calls upon committees to cut $800 billion from non-defense discretionary outlays, and would achieve $850 billion in further savings by phasing out the Overseas Contingency Operations emergency accounts that fund combat operations. The plan would slow the growth of entitlement spending by $4.1 trillion. Health programs would absorb $1.8 trillion of those cuts, including $1 trillion from Medicaid and $473 billion from Medicare.

John Cornyn, R-Texas, said entitlement spending is growing at 5.5 percent per year, which is “why we are seeing huge annual deficits and unsustainable debt. So restraining spending is an important goal of our budget. Reducing nondefense discretionary spending is also important.”

Patrick Leahy, D-Vt., said: “This budget invests in millionaires and billionaires like the Trump family, the Koch brothers, wealthy corporations and the top 1 percent. It turns its back on millions of hard-working American families.”

A yes vote was to adopt the Republican budget blueprint for 2018-2027.

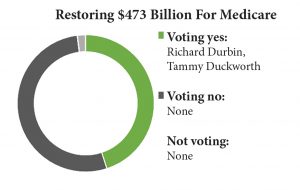

Restoring $473 Billion For Medicare: Voting 47 for and 51 against, the Senate on Oct. 18 defeated a Democratic attempt to delete from the Republican budget plan for fiscal 2018-2027 (H Con Res 71, above) language endorsing $473 billion in Medicare spending reductions. The cost of the amendment would be offset with increased revenue from changes in unspecified tax provisions. Republicans say Medicare cuts would help control entitlement spending that is the major cause of expanding federal debt. But Democrats contend the GOP is targeting entitlement programs including Medicare and Medicaid mainly to finance tax cuts for the wealthy.

Restoring $473 Billion For Medicare: Voting 47 for and 51 against, the Senate on Oct. 18 defeated a Democratic attempt to delete from the Republican budget plan for fiscal 2018-2027 (H Con Res 71, above) language endorsing $473 billion in Medicare spending reductions. The cost of the amendment would be offset with increased revenue from changes in unspecified tax provisions. Republicans say Medicare cuts would help control entitlement spending that is the major cause of expanding federal debt. But Democrats contend the GOP is targeting entitlement programs including Medicare and Medicaid mainly to finance tax cuts for the wealthy.

Chris Van Hollen, D-Md., said Republicans “have big tax cuts for the super-wealthy paid for by increasing the tax burden on tens of millions of middle-class Americans…by cutting Medicare and Medicaid. Then, at the end of all of that, this budget is actually designed to increase the national debt by $1.5 trillion.”

Orrin Hatch, R-Utah, said Democrats “have argued that the budget would cut Medicare spending, but that just isn’t true. In fact, in this budget Medicare spending would increase every year, though at a slightly slower rate in order to introduce some level of fiscal sanity into the process.”

A yes vote was in opposition to cutting Medicare.

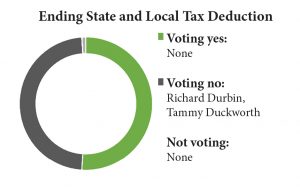

Ending State and Local Tax Deduction: Voting 52 for and 47 against, the Senate on Oct. 19 adopted a GOP amendment to H Con Res 71 (above) intended to clear the way for later legislative action to end or limit the federal income tax deduction for taxes paid at the state and local level. Federal taxpayers who itemize deductions subtract state and local taxes from their gross income. Republicans say they intend to repeal or narrow the deduction and use the resulting additional revenue to help offset the cost of tax cuts. Some 43 million taxpayers claim the deduction, which is most beneficial to high-income residents of high-tax states, according to the non-partisan Tax Foundation.

Ending State and Local Tax Deduction: Voting 52 for and 47 against, the Senate on Oct. 19 adopted a GOP amendment to H Con Res 71 (above) intended to clear the way for later legislative action to end or limit the federal income tax deduction for taxes paid at the state and local level. Federal taxpayers who itemize deductions subtract state and local taxes from their gross income. Republicans say they intend to repeal or narrow the deduction and use the resulting additional revenue to help offset the cost of tax cuts. Some 43 million taxpayers claim the deduction, which is most beneficial to high-income residents of high-tax states, according to the non-partisan Tax Foundation.

Shelly Moore Capito, R-W.Va., said: “Keeping the state and local tax deduction without modification would cost more than $1 trillion over 10 years. That money would be better spent on relief for the middle class.”

Ron Wyden, D-Ore., said “more than half of the taxpayers claiming the state and local deduction make less than $100,000. These hard-working, middle-class folks are not going to appreciate Congress double-taxing them.”

A yes vote was to advance repeal of the state and local tax deduction.

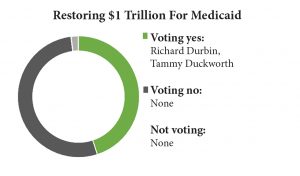

Restoring $1 Trillion For Medicaid: Voting 47 for and 51 against, the Senate on Oct. 18 defeated a Democratic amendment that sought to restore approximately $1 trillion in Medicaid spending reductions proposed by the Republican-drafted budget plan (H Con Res 71, above) over 10 years. The cost of the amendment would be offset by an equal amount of additional taxes paid by the top 1 percent of U.S. taxpayers.

Restoring $1 Trillion For Medicaid: Voting 47 for and 51 against, the Senate on Oct. 18 defeated a Democratic amendment that sought to restore approximately $1 trillion in Medicaid spending reductions proposed by the Republican-drafted budget plan (H Con Res 71, above) over 10 years. The cost of the amendment would be offset by an equal amount of additional taxes paid by the top 1 percent of U.S. taxpayers.

Minority Leader Charles Schumer, D-N.Y., said: “If my colleagues are OK with a trillion dollars of cuts in Medicaid, let them vote against the amendment. But believe me, the American people will know exactly how each member of the chamber feels when it comes to cutting Medicaid dramatically.”

Orrin Hatch, R-Utah, said Democrats “like to claim that…every problem will be solved if we simply raise taxes on rich people. But anyone who has spent more than five minutes looking at the fiscal condition of our federal health programs will tell you that that is preposterous. The money just simply isn’t there.”

A yes vote was in opposition to Medicaid cuts in the 10-year budget plan.

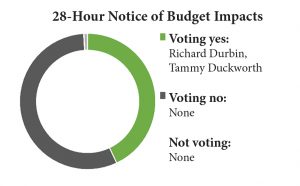

28-Hour Notice of Budget Impacts: Voting 48 for and 51 against, the Senate on Oct. 19 refused to strip H Con Res 71 (above) of its waiver of a rule designed to provide lawmakers and constituents with advance information on the content of bills — such as tax-code overhaul — considered under so-called “reconciliation” procedures. The rule requires such bills to be publicly scored by the Congressional Budget Office at least 28 hours before they are called up for debate.

28-Hour Notice of Budget Impacts: Voting 48 for and 51 against, the Senate on Oct. 19 refused to strip H Con Res 71 (above) of its waiver of a rule designed to provide lawmakers and constituents with advance information on the content of bills — such as tax-code overhaul — considered under so-called “reconciliation” procedures. The rule requires such bills to be publicly scored by the Congressional Budget Office at least 28 hours before they are called up for debate.

Amendment sponsor Tim Kaine, D-Va., said: “There should be a CBO score to let every senator and especially the public know what we are voting on with respect to these matters.”

Mike Enzi, R-Wyo., said “the 28-hour rule is a recent creation, and its repeal shows no deviation from Senate practice.”

A yes vote was to retain the budget transparency rule.

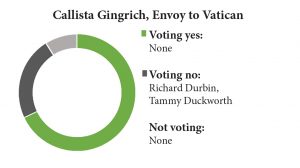

Callista Gingrich, Envoy to Vatican: Voting 70 for and 23 against, the Senate on Oct. 16 confirmed Callista L. Gingrich, 51, as U.S. ambassador to the Holy See, a sovereign entity in Rome that is the world’s smallest country. The wife of former House speaker and GOP presidential hopeful Newt Gingrich, she is an author of children’s books and former president of both The Gingrich Foundation and a media production company.

Callista Gingrich, Envoy to Vatican: Voting 70 for and 23 against, the Senate on Oct. 16 confirmed Callista L. Gingrich, 51, as U.S. ambassador to the Holy See, a sovereign entity in Rome that is the world’s smallest country. The wife of former House speaker and GOP presidential hopeful Newt Gingrich, she is an author of children’s books and former president of both The Gingrich Foundation and a media production company.

Catherine Cortez Masto, D-Nev., said: “Ms. Gingrich’s faith and engagement with the Catholic community will support U.S. ties to the Vatican.”

No senator spoke against the nominee.

A yes vote was to confirm Gingrich as American envoy to the Vatican City.