Illinois Representatives’ Votes in Congress

Chronicle Media — November 25, 2015United States Senate

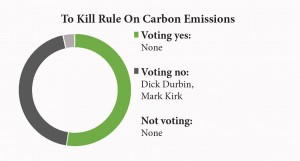

To Kill Rule On Carbon Emissions: Voting 52 for and 46 against, the Senate on Nov. 17 adopted a measure (SJ Res 24) that would kill a new Environmental Protection Agency rule to limit carbon emissions by natural gas- and coal-fired power plants. The bill targets the EPA’s so-called Clean Power Plan, which would allow each state to develop its own means of complying with federally set limits on carbon discharges from plants that generate electricity. These emissions make up about one-third of greenhouse-gas discharges in the U.S and are the nation’s largest source of carbon pollution, according to the EPA. Critics say the rule would cost jobs in coal country and damage the overall U.S. economy.

To Kill Rule On Carbon Emissions: Voting 52 for and 46 against, the Senate on Nov. 17 adopted a measure (SJ Res 24) that would kill a new Environmental Protection Agency rule to limit carbon emissions by natural gas- and coal-fired power plants. The bill targets the EPA’s so-called Clean Power Plan, which would allow each state to develop its own means of complying with federally set limits on carbon discharges from plants that generate electricity. These emissions make up about one-third of greenhouse-gas discharges in the U.S and are the nation’s largest source of carbon pollution, according to the EPA. Critics say the rule would cost jobs in coal country and damage the overall U.S. economy.

Shelley Moore Capito, R-W.Va., said the resolution sends “a clear message to the world that a majority of the Congress does not stand behind the president’s efforts to address climate change with economically catastrophic regulations.”

Barbara Boxer, D-Calif., said “most (Senate Republicans) don’t even believe climate change is happening. They say: `Well, we are not scientists.’ That is right; you are not. So why not listen to the 98 percent of scientists who know this is happening?”

A yes vote was to send the measure to the House, which is expected to send it to President Obama, who has promised a veto.

United States House of Representatives

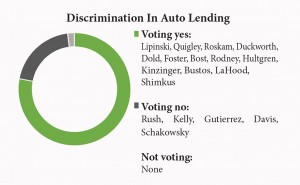

Discrimination In Auto Lending: Voting 332 for and 96 against, the House on Nov. 18 passed a bill (HR 1737) that would halt Consumer Financial Protection Bureau regulation of auto loans with discriminatory interest rates. The agency says it has authority under the Equal Credit Opportunity Act over indirect (third-party) auto lending in which minorities are charged higher rates than similarly qualified white customers. But critics say the 2010 Dodd-Frank law prohibits the agency from regulating auto dealerships. Next to home mortgages and student loans, auto loans are the third largest source of household debt in the U.S.

Discrimination In Auto Lending: Voting 332 for and 96 against, the House on Nov. 18 passed a bill (HR 1737) that would halt Consumer Financial Protection Bureau regulation of auto loans with discriminatory interest rates. The agency says it has authority under the Equal Credit Opportunity Act over indirect (third-party) auto lending in which minorities are charged higher rates than similarly qualified white customers. But critics say the 2010 Dodd-Frank law prohibits the agency from regulating auto dealerships. Next to home mortgages and student loans, auto loans are the third largest source of household debt in the U.S.

Tom Cole, R-Okla., said the bureau has attempted “to extend their authority into auto lending, which is specifically prohibited” by the Dodd-Frank law.

John Sarbanes, D-Md., said: “Let the (bureau) do the job that it was given, which it is doing very well.”

A yes vote was to send the bill to the Senate.

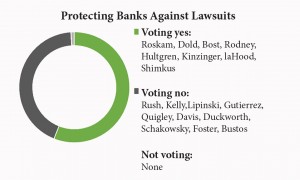

Protecting Banks Against Lawsuits: The House on Nov. 18 voted, 255 for and 174 against, to grant protection against most consumer lawsuits to community banks and credit unions issuing risky home loans if they keep the loan in their portfolio. In part, the bill (HR 1210) would protect institutions making loans to borrowers who have excessive debt-to-income ratios or fail to fully document their repayment ability. The protection also applies in instances of interest-only loans, loans with excessive upfront charges and loans allowing principal to grow even when payments are being made. Under the bill, creditors making such loans would receive the same insulation from lawsuits available to providers of what the Consumer Financial Protection Bureau defines as “qualified mortgages.” These are mortgages in which the lender has made a good faith effort to establish the borrower’s ability to repay the loan.

Protecting Banks Against Lawsuits: The House on Nov. 18 voted, 255 for and 174 against, to grant protection against most consumer lawsuits to community banks and credit unions issuing risky home loans if they keep the loan in their portfolio. In part, the bill (HR 1210) would protect institutions making loans to borrowers who have excessive debt-to-income ratios or fail to fully document their repayment ability. The protection also applies in instances of interest-only loans, loans with excessive upfront charges and loans allowing principal to grow even when payments are being made. Under the bill, creditors making such loans would receive the same insulation from lawsuits available to providers of what the Consumer Financial Protection Bureau defines as “qualified mortgages.” These are mortgages in which the lender has made a good faith effort to establish the borrower’s ability to repay the loan.

Jeb Hensarling, R-Texas, said “mortgages that are held in portfolio are already prudently regulated by market discipline. Yet without a safe harbor from the threat of litigation, which (this bill) would provide, lenders will not make loans to otherwise creditworthy individuals.”

Maxine Waters, D-Calif., said Republicans “are forgetting the lessons of 2008, forgetting what happened when we brought this country to a recession, almost a depression, forgetting the communities that have been destroyed with these foreclosures….and presenting legislation that could put them back in the same position.”

A yes vote was to send the bill to the Senate.

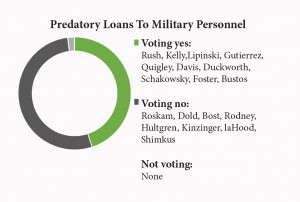

Predatory Loans To Military Personnel: Voting 184 for and 242 against, the House on Nov. 18 defeated a Democratic motion to allow consumer lawsuits to proceed under HR 1210 (above) against lenders alleged to have made predatory home loans to active-duty military personnel and veterans.

Predatory Loans To Military Personnel: Voting 184 for and 242 against, the House on Nov. 18 defeated a Democratic motion to allow consumer lawsuits to proceed under HR 1210 (above) against lenders alleged to have made predatory home loans to active-duty military personnel and veterans.

Mike Thompson, D-Calif., said: “On the heels of Veterans Day, when member after member came to the floor to praise our veterans, this (GOP) majority wants to return seven days later and put predatory lenders ahead of our men and women in uniform. Their bill limits consumer protections for service members.”

Jeb Hensarling, R-Texas, said “at the end of the day, what is going to be best for our veterans — what is going to be best for the American people — is more competition in the mortgage market, not less, not taking away their financing opportunities, particularly those who are of low income and particularly our veterans.”

A yes vote was to adopt the motion, which, had it prevailed, would have immediately amended the bill.

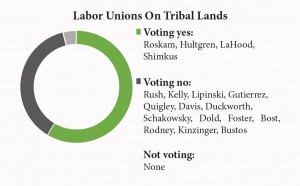

Labor Unions On Tribal Lands: Voting 249 for and 177 against, the House on Nov. 17 passed a bill (HR 511) to remove Indian reservations from the jurisdiction of the National Labor Relations Act (NLRA) on grounds they are sovereign nations not subject to that New Deal-era law. This would take away collective-bargaining and other federally guaranteed workplace rights now exercised by more than 600,000 casino workers on reservations, about three-fourths of whom are not tribal members. The National Labor Relations Board has applied the NLRA to commercial enterprises on reservations since 2004.

Labor Unions On Tribal Lands: Voting 249 for and 177 against, the House on Nov. 17 passed a bill (HR 511) to remove Indian reservations from the jurisdiction of the National Labor Relations Act (NLRA) on grounds they are sovereign nations not subject to that New Deal-era law. This would take away collective-bargaining and other federally guaranteed workplace rights now exercised by more than 600,000 casino workers on reservations, about three-fourths of whom are not tribal members. The National Labor Relations Board has applied the NLRA to commercial enterprises on reservations since 2004.

Jan Schakowsky, D-Ill. said she backs tribal sovereignty but also supports labor rights, “the ability of hardworking men and women to join together in collective bargaining to improve their workplace and the lives of their families.”

Kristi Noem, R-S.D., said: “The last thing (tribes) need is to have the National Labor Relations Board meddling in their economic development affairs when they are trying to make life better for the people who live in their communities.”

A yes vote was to send the bill to the Senate.

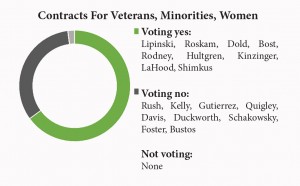

Contracts For Veterans, Minorities, Women: Voting 285 for and 138 against, the House on Nov. 17 passed a bill (HR 1694) that would enable veteran-owned businesses to compete against women- and minority-owned businesses in a program that sets a goal of awarding 10 percent of Department of Transportation infrastructure projects to disadvantaged firms. At present, access to the Disadvantaged Business Enterprise (DBE) program is limited to “economically and socially disadvantaged” firms that are at least 51 percent owned by African Americans, Hispanics, Native Americans, Asian Americans or women. The bill would add thousands of veteran-owned firms to competition for a fixed number of highway and mass-transit construction contracts.

Contracts For Veterans, Minorities, Women: Voting 285 for and 138 against, the House on Nov. 17 passed a bill (HR 1694) that would enable veteran-owned businesses to compete against women- and minority-owned businesses in a program that sets a goal of awarding 10 percent of Department of Transportation infrastructure projects to disadvantaged firms. At present, access to the Disadvantaged Business Enterprise (DBE) program is limited to “economically and socially disadvantaged” firms that are at least 51 percent owned by African Americans, Hispanics, Native Americans, Asian Americans or women. The bill would add thousands of veteran-owned firms to competition for a fixed number of highway and mass-transit construction contracts.

Michael Fitzpatrick, R-Pa., said the bill would put “the most trained workforce in history on the job of rebuilding our nation’s roads and bridges.”

Eleanor Holmes Norton, D-D.C., said the bill “could destroy the entire (DBE) program, taking everything down with it, including the veterans it purports” to help.

A yes vote was to send the bill to the Senate, where it stands a chance of advancing.

— Illinois Representatives’ Votes in Congress —