Pritzker-tied group launches first TV ad promoting ‘fair tax’

By Jerry Nowicki Capitol News Illinois — March 23, 2019

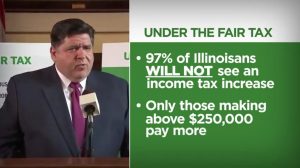

Gov. J.B. Pritzker is pictured in a screenshot from a Think Big Illinois ad which will soon hit television airwaves across the state. Think Big Illinois is a 501(c)4 organization which has not yet released its donors, although Pritzker has admitted to donating to the group, and it is run by one of his former campaign staffers. (Credit: Think Big Illinois YouTube channel)

SPRINGFIELD – A dark money group that counts Democratic Gov. J.B. Pritzker among its donors has launched its first television advertisement supporting the governor’s signature graduated income tax proposal.

Think Big Illinois, whose other donors have not yet been made public, launched an ad called “hole,” framing Pritzker’s tax plan as a solution to Illinois’ $3.2 billion budget deficit. It will run in media markets across the state, the group announced Thursday.

“There’s a $3.2 billion hole in Springfield. And after years of ignoring it, we can’t keep doing more of the same,” a narrator in the ad says over informational graphics and video of Pritzker engaging with constituents.

Minutes after Think Big announced the 30-second spot in a press release Thursday, Ideas Illinois, a dark money group on the opposite side of the tax fight, announced a longer digital-only ad in a press release.

“Pritzker and Madigan want to change the constitution to allow a permanent jobs tax on middle class families. ‘Trust us,’ they say: we’ll use your money to fund our schools, fix our roads, shore up pensions and cut property taxes. Do you trust them?” a narrator asks.

Passage of a constitutional amendment to allow for Pritzker’s graduated tax plan would require approval from 60 percent of those voting on the question or half of those voting in the November 2020 presidential election, should the Legislature muster the three-fifths majorities in each chamber to put a question on the ballot.

If the constitutional amendment is successful, the Legislature would have the authority to pass a graduated structure, and the one proposed by Pritzker lowers the tax rate modestly for all single- or jointly-filing earners with an income of $250,000 or less in a year.

The current tax rate is a flat 4.95 percent on every Illinoisan. Under Pritzker’s plan, only earners whose income exceeds $1 million would be taxed at a flat rate — 7.95 percent — on every penny of income.

For all other earners, filing jointly or alone, different rates ranging from 4.75 percent to 7.85 percent would apply to different margins of income.

The lowest bracket’s rate is 4.75 percent and it applies to an earner’s income from $0 to $10,000. Once an earner’s income reaches the second bracket, the 4.75 rate would still apply to the first $10,000, and a 4.9 percent rate would apply from income between $10,001 and $100,000.

This structure continues through bracket three (4.95 percent on income margins between $100,001 and $250,000), bracket four (7.75 percent for income margins between $250,001 and $500,000) and bracket five (7.85 percent for income between $500,001 and $1 million).

Per this structure, fewer than 20,000 Illinois households claiming more than $1 million in taxable income would provide $2.7 billion of an estimated $3.4 billion in added revenue, according to the governor’s office.

Ideas Illinois portrays the ad as a “jobs tax” and a “blank check” to Springfield lawmakers that have “broken promises” in the past. Think Big calls it a “fair tax,” the preferred language of the governor.

The ads have been launched a full 20 months ahead of the November 2020 election, which is the earliest the question could be put on the ballot.

Both Ideas Illinois and Think Big Illinois are 501(c)4 organizations, which means their donor lists do not need to be disclosed publicly, although Think Big has said they will release their donors eventually.

“Think Big Illinois believes in bringing transparency and accountability to our public discussions around important policy issues facing this state. As a result, our organization will be voluntarily disclosing our donors to the public when we file our annual nonprofit tax returns,” they said in a February release.

Illinois Policy, the 501(C)4 advertising wing of the Illinois Policy Institute, has been running digital ads against the tax plan as well.

Jnowicki@capitolnewsillinois.com