Big GOP donor to Rauner gives $20 million to fight graduated tax

By Jerry Nowicki Capitol News Illinois — September 8, 2020SPRINGFIELD – Illinois’ wealthiest man and frequent Republican political donor Ken Griffin has pledged $20 million to a group dedicated to defeating a graduated tax constitutional amendment.

Griffin, who is the founder of the hedge fund Citadel, has previously donated tens of millions of dollars to the campaign of Republican former Gov. Bruce Rauner. He’s also given millions to House and Senate Republican leadership in the state and donated to several individual lawmakers. Forbes estimates his net worth at $15 billion.

His recent $20 million donation went to the Coalition to Stop the Proposed Tax Hike Amendment ballot initiative committee. Prior to Griffin’s donation, the committee had received $950,000 in donations.

Gov. J.B. Pritzker has already dropped more than $50 million of his own personal fortune, estimated at $3.4 billion, in support of his marquee legislative proposal. His donation went to the Vote Yes for Fairness ballot initiative committee.

The constitutional amendment in question would scrap the state’s protection of a flat-rate income tax for a new structure allowing lawmakers to tax different levels of income at fluctuating tax rates. A progressive rate structure that would take effect if the amendment passes is expected to bring in more than $1 billion in additional state revenue this fiscal year and more than $3 billion annually when it is implemented for a full fiscal year.

It will be up to the voters in November as to whether the state gains authority to scrap the flat tax, which is currently 4.95 percent for every penny of taxable income for every taxpayer. If more than half of those voting in the November election, or three-fifths of those voting on the ballot question, approve the measure, a graduated rate structure can take effect.

Lawmakers have already approved the rate structure that will become law should the measure pass.

Effective Jan. 1, rates would remain flat or decrease for those earning $250,000 or less, while they would increase for those earning above that amount.

Individuals earning more than $750,000 and joint filers with incomes exceeding $1 million would see the largest tax increases. A flat tax rate of 7.99 percent on all income would apply to anyone exceeding those thresholds.

For all other earners, each varying tax rate would apply to only one specific margin of income.

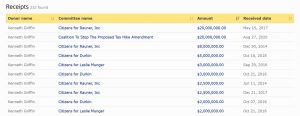

A snapshot of billionaire Ken Griffin’s largest political donations. (Graphic from Illinoissunshine.org)

The rates are 4.75 percent on taxable income from $0 to $10,000; 4.9 percent from $10,001 to $100,000; 4.95 percent from $100,001 to $250,000.

For joint filers, a 7.75 percent rate would kick in on margins from $250,001 to $500,000; and 7.85 percent from $500,001 to $1 million. For single filers, the 7.75 percent rate applies from $250,001 to $350,000, while the 7.85 percent rate applies from $350,001 to $750,000.

The measure also includes an increase in the property tax credit from 5 percent to 6 percent, and up to a $100 per-child tax credit for couples earning less than $100,000 and single persons earning less than $80,000.

The corporate tax rate would go from 7 to 7.99 percent, not including an existing corporate property replacement tax of 1.5 to 2.5 percent that is not changed by the bill.

Opponents of the graduated tax have not disputed the rates that will become law upon its passage, but they argue that the change does not put safeguards in place to prevent future adjustments to the rate structure that could impose higher taxes on lower levels of income.

The necessary threshold to raise taxes in the General Assembly would remain unchanged by the amendment, although opponents argue it would make the task politically easier by allowing lawmakers to raise taxes on different tax brackets at different times.

In light of receiving the big check from Griffin, the Coalition said in a statement it “welcomes support from anyone who believes we must stop Springfield politicians from having new power to increase income taxes on every group of taxpayers, whenever they want.”

“The constitutional amendment sets no limit on the number of tax brackets that can be created and no limit on how high tax rates can be increased on groups of individual taxpayers – including middle-income families,” the statement added.

Earlier in the week, more than 125 labor unions organized by the Vote Yes for Fair Tax ballot initiative committee hosted a virtual news conference to announce their support for the measure.

“Yesterday—the day that unions representing more than 1 million Illinois workers stood up to support Fair Tax reform—the state’s richest billionaire Ken Griffin spent $20 million to protect the broken status quo,” John Bouman, the chairman of the group, said in a news release. “Griffin took home $1.5 billion in 2019 alone, yet paid the same state income tax rate as teachers, nurses, grocery store clerks and other essential workers. That’s wrong and it’s exactly why Illinois needs the Fair Tax amendment.”

In August, the Illinois State Black Chamber of Commerce and the Illinois Hispanic Chamber of Commerce announced opposition to the graduated tax as well, warning of the effects a tax hike could have on job creators.

Proponents, however, point out that small businesses owners operating as sole proprietors or pass-through entities such as S-corporations will see a tax reduction under the plan if they have less than $250,000 in annual income.

jnowicki@capitolnewsillinois.com