Bush-era measure reinvigorated by imminent ‘Cadillac Tax’ in Obamacare

Illinois News Network — December 22, 2016

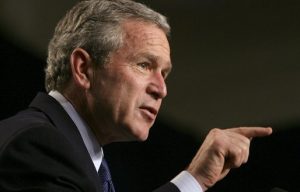

One of the most publicized parts of Obamacare that hasn’t even taken effect yet is inadvertently spurring on one of George W. Bush’s primary health care reform measures. (Photo by Eric Draper)

One of the most publicized parts of Obamacare that hasn’t even taken effect yet is inadvertently spurring on one of George W. Bush’s primary health care reform measures.

The Cadillac Tax component of the Affordable Care Act is set to take effect in 2020. The goal is to penalize businesses from offering plans so generous that employees over-use their health coverage. Employers, in turn, are already making changes to avoid the coming tax, such as increasing deductibles. University of Illinois law professor Richard Kaplan said the changes are making many employees eligible for the Bush-championed Health Savings Accounts (HSAs).

“As it turns out, by increasing the annual deductible, that then makes these employees eligible for HSAs,” he said.

Thus, President Obama’s signature health care reform law could ultimately implement Bush’s own health care approach. Even if Republicans repeal the ACA, Kaplan said their alternate plan includes a law similar to the Cadillac Tax. Kaplan said Obama’s law tried to push people away from HSAs by requiring higher deductibles on them.

“HSAs focus on the consumer, while the Cadillac excise tax focuses on the employer. It turns out that they sort of meet in the middle.”

Kaplan said a vast number of people on Illinois’ health care exchanges would be eligible for HSAs because they have high deductibles. According to the Federal Centers for Medicaid and Medicare Services, there are currently more than 330,000 Illinoisans with state marketplace coverage.

— Bush-era measure reinvigorated by imminent ‘Cadillac Tax’ in Obamacare —