Tazewell County seeks voter approval for tax rate hike

By Holly Eitenmiller For Chronicle Media — November 13, 2017

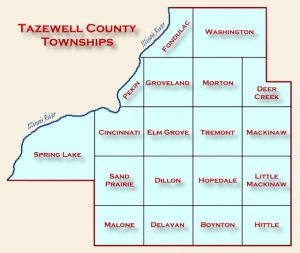

A breakdown of taxing bodies for a Tazewell County property with a net taxable value of $29,850. At a 9.142 percent tax rate, this homeowner paid $2,728.90 in taxes last year, $149 of which to Tazewell County. (Chart courtesy of Tazewell County)

For the first time in 15 years, the Tazewell County Board is seeking to raise property taxes — a move aimed to prevent deficit spending in the second-lowest county for property tax in Illinois.

But first, they have to get permission from the taxpayers. On Oct. 25, the County Board unanimously approved placing a referendum on the March ballot for a 15 cent property tax rate increase through 2021.

It may not seem like much, Board Chairman David Zimmerman said, but it equates to a 30 percent increase for Tazewell County property owners.

“Property owners pay 49 cents per $100 of assessed valuation. We’re asking to up to 64 cents per hundred,” he said. “Conversely, that’s an increase of 30 percent. I’m sure people are saying, ‘Wow, what are you guys doing down there in Tazewell?’ We want to communicate clearly what that means.”

In dollars, that’s an average of around $50 per residence, totaling more than $4 million in revenue. Tazewell County is second behind Mercer County with the lowest tax rate in Illinois.

In dollars, that’s an average of around $50 per residence, totaling more than $4 million in revenue. Tazewell County is second behind Mercer County with the lowest tax rate in Illinois.

“Every tax increase is significant, but when you put it helps to put it into context with the other counties,” Zimmerman said. “With the increase, we’ll still be fifth out of 102 counties, and we’re fortunate in Tazewell county that we don’t have any debt and we have healthy finances.”

Recent changes by the General Assembly to the Illinois budget have curtailed already meager allowances to local governments. Such cutbacks, along with unfunded state mandates, like same-day voter registration and 911 emergency center consolidation, are putting the county’s books in the red.

“We’ve been a very lean county. We can afford to deficit spend for a short time, but, eventually, that’ll catch up with us,” Zimmerman said. “Consolidation of our 911 centers will cost $2.5 million to implement.”

Regardless of whether or not the referendum passes, Zimmerman said cuts still will be made to various county departments. Without the increase, however, the cuts will be deeper.

“We will have to make cuts. It’s not a threat, it’s a reality,” he said. “We look across the board, though, and it’s not one department more than any other department.”

Still, it will be up to taxpayers to approve the hike. In March, 1998, Tazewell County implemented the Property Tax Extension Limitation Law, PTELL, which limits total taxes billed by whichever is lower; the current Consumer Price Index or 5 percent.

Under this tax cap, voters must approve a higher levy. The opportunity to do so is March 20, 2018.

—- Tazewell County seeks voter approval for tax rate hike —–