Pritzker: Either rich pay more or everyone pays more

By Kevin Beese Staff reporter — March 12, 2019

Gov. J.B. Pritzker talks during a press conference Thursday about alternatives to going with a “fair tax,” such as cutting state services by 15 percent or hiking everyone’s tax rate 20 percent. (BlueRoomStream.com)

Gov. J.B. Pritzker is calling on top earners in the state to step up to the plate and do what is right by paying more to help the state out of its financial woes.

Pritzker said that top earners paying more would stabilize the state’s finances and lead to more business relocations into the state and job growth.

“We cannot go longer with a budget that is not actually paying the bills and the bill backlog,” Pritzker said in kicking off negotiations for his “fair tax” with a press conference Thursday.

Under the Pritzker plan, individuals earning more than $250,000 would pay 3 percent more in state taxes. The corporate tax rate would also increase, by 0.95 percent.

“It’s time we stop playing games and balance the budget,” Pritzker said.

He noted that 97 percent of Illinois residents would pay the same or less in state taxes than they currently do, under his proposal.

Pritzker said he is willing to talk with both Republican and Democratic leaders about the proposal, but said the current flat tax system in the state needs to go.

“As I said throughout the (gubernatorial) campaign, Illinois’ flat tax system is unfair to the middle class and those striving to get there. People like me should pay more and people like you,” the billionaire said to reporters, “should pay less. That’s what the fair tax will do.”

The state’s top Democrat said that instituting a “fair tax” would improve the arc of state finances forever and make the state taxing system more fair for everyone.

“It’s wrong that I would pay the same tax rate as someone earning $100,000 – or even worse pay the same tax rate as someone earning $30,000 – which is why 33 states and the federal government use lower rates for lower earnings and higher rates for higher earnings,” Pritzker said.

Pritzker said in order to stabilize its finances the state has to cut government services by 15 percent, raise taxes on everyone in the state by 20 percent or have the rich pay a higher tax rate.

He said service cuts would mean larger class sizes, higher costs for kids going to college and fewer state police. Pritzker said it would also mean higher local property taxes as more things would be pushed to local municipalities.

He said raising everyone’s taxes 20 percent would hike the income tax on the working poor and middle class from 4.95 percent to at least 5.95 percent – a $521 increase for a $61,000 wage earner.

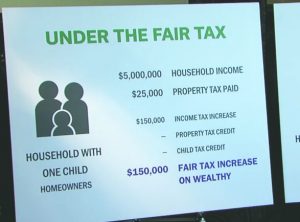

An information board at Pritzker’s press conference shows the impact his proposed “fair tax” would have on a couple making $5 million and having one child. (BlueRoomStream.com)

“The ‘fair tax’ would eliminate the budget deficit, balance future budgets and reduce the pension liability by producing revenue of $3.4 billion,” Pritzker said.

He noted that his proposal would provide a $100 million increase in the property tax credit for homeowners. That would mean a single homeowner making less than $250,000 would see an increase in their property tax write-off of 20 percent.

Pritzker said his tax plan would also offer a tax credit of $100 per child for single parents making less than $40,000 per year.

He said the plan would keep Illinois competitive with its neighbors, noting that most families in Iowa and Wisconsin pay more in income taxes under their current tax systems than they would if they lived in Illinois under the “fair tax” system.

“There are those who want to scare people by claiming that this proposal will cause residents and businesses to flee Illinois. They couldn’t be more wrong,” Pritzker said. “They ignore the fact that people and businesses are fleeing our state now under our current regressive tax system, yet states with fair tax systems on average grow faster and create more jobs than Illinois.

“It’s time we stabilized our state’s finances so we can give businesses and new entrepreneurs the certainty that Illinois has its fiscal house in order. “

Like and follow us on Facebook

Agency backs changing tax code

Think Big Illinois, a left-leaning policy agency, is backing the governor’s proposed change in the state’s tax system.

Quentin Fulks, the group’s executive director, released a statement in response to attacks on the proposed tax rates.

“(The) proposed tax rates are an important step toward creating a fair tax system that works for everyone, so it shouldn’t come as a surprise that outside groups funded by the wealthiest Illinoisans are quick to launch desperate, false attacks,” Fulks said. “While these outside groups and their wealthy donors will do or say anything to avoid finally having to pay their fair share, the fact is Illinois needs a fair tax to modernize our tax code, boost the economy, and address the dire financial situation we’ve been left in after years of irresponsible governance and mismanagement.

“Under the fair tax system, 97 percent of Illinoisans will receive tax relief, with only families making upwards of $250,000 a year paying more. This structure will also lift the burden off middle-class and working families and provide $100 million in property tax relief, but that won’t stop opponents from fighting to prevent Illinoisans from even having the opportunity to vote to implement a fair tax.

“False attacks from those whose bottom lines will be hurt by a fair tax will undoubtedly continue, but Think Big Illinois remains committed to standing with working families and educating Illinoisans about how a fair tax will help them, their communities and our state.”

Think Big Illinois officials say they are committed to fighting for progressive policies and supporting the changes necessary to help repair the state. Think Big Illinois believes in pursuing policies that help all working families, including investing in quality education for our children, expanding access to affordable health care, passing a progressive income tax, fighting for women’s rights, investing in our state’s infrastructure, helping seniors retire with dignity, and creating a fair and equal criminal justice system.