Taxes higher compared to home values in south Cook suburbs

By Jean Lotus Staff Reporter — June 28, 2016

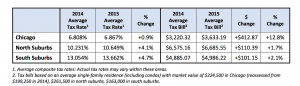

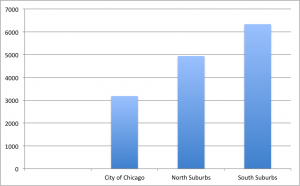

Property taxes owed in Cook County for a $200,000 home in different locations. (Source: Cook County Clerk)

New tax rates released by Cook Count Clerk David Orr show residents in the south suburbs pay almost twice the amount of property taxes per dollar of their home’s value than homeowners in Chicago, and 25 percent more than homeowners in the northern suburbs.

The new rates also reveal that Chicagoans can expect their tax bill to increase by almost 13 percent.

In mid-June, Orr’s office released the final numbers for 2015 tax rates for 1,400 Cook County taxing bodies. These include school and park districts, libraries, fire protection districts, townships and other more obscure agencies that take a bite of residents’ property tax bills, due Aug. 1.

Properties in the City of Chicago were reassessed in 2015 resulting in a 9.3 increase in equalized assessed value (EAV) across the city. The assessed market value of an average Chicago home increased from $199,000 in 2014 to $224,500 in 2015. Chicago also levied an extra $318 million for pensions, the county clerk’s office said. The Chicago taxpayer owning a $224,500 home will pay an average of $3,633.19 or $418 more for 2015 taxes than in 2014 rate of $3,220.22.

In the suburbs, the average tax bills should rise by less than $120, the clerk’s office said. The average change will be about 1.7 percent higher in the north suburbs from $6,575.16 in 2014 to $6,685.55.

The tax hike will be a modest 2.10 percent in the southern suburbs from an average of $4,885.07 in 2014 to $4,986.22 in 2015.

Even though it appears these numbers seem to favor homeowners in the south suburbs, tax rates as compared to home value are much higher in southern Cook towns where home values are still depressed from the real estate crash.

The clerk’s office explains that because the southern suburbs have a much lighter industrial and commercial base than Chicago, the tax rate percentage is higher.

The differerence in tax rates is clear when total tax rates are compared with homes of equal assessed market value. For a home with a market value of $200,000 in Chicago, this works out to property taxes of $3,184.23, or about $160 per $10,000 of assessed value. For the north suburbs, the tax amount on a $200,000 house or condo is $4,937.94, or $246.90 per $10,000 of value. But in the southern suburbs, taxes on a $200,000 residential property will average $6,335.07, or $306 per $10,000 of value.

The three Cook County suburbs (all in the “Southland”) with the highest consolidated property tax rates are the Village of Ford Heights with a rate of 37.976 percent, the Village of Park Forest with a rate of 36.834 percent and the City of Chicago Heights with a rate of 33.726 percent.

With foreclosures and fewer residential and commercial properties to help bear the tax burden, these towns ask for more from the taxpayers who remain, keeping an economic thumb on the recovery of real estate values. The average market value of a home in Ford Heights is $26,500, according to a Sept., 2015 article in Chicago Lawyer magazine.

But Orr’s report also had examples of municipalities with very low tax rates. Chicago’s tax rate is among the lowest in the county at 6.867 percent. The villages of Barrington and South Barrington have the next-lowest tax rates at 7.384 percent and 7.530 percent respectively, the report said.

Orr’s office also said the total amount of property taxes in Cook expected to be collected exceeded $13 billion for the first time, up from $12.4 billion last year.

The City of Chicago expected to collect more than $1 billion for the first time, up 34 percent from the 2014 amount of $774 million.

Read the current issue of the Cook County Chronicle

Free digital subscription to the Cook County Chronicle

— Taxes higher compared to home values in south Cook suburbs –