Minorities, women encouraged to invest in Chicago casino

By Igor Studenkov For Chronicle Media — January 23, 2025

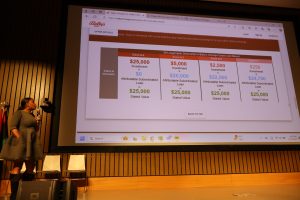

Sidney Dillard, head of Loop Capital’s corporate investment banking division, explains how casino shares would work. (Photo by Igor Studenkov/for Chronicle Media)

When the Chicago City Council accepted Bally’s Corp. proposal to build the city’s first casino, one of the conditions was that, when it starts selling shares, at least 25 percent of them must go to women and minority investors.

The casino launched its initial public offering at the end of 2024, hiring Loop Capital Markets to handle the particulars. However, there is a relatively narrow window for minority investors — they have until Jan. 31 to apply. To try to get the word out, Chicago City Treasurer Melissa Conyears-Ervin and the City Council’s Aldermanic Black Caucus held two workshops. The West Side workshop was held Jan. 14 at Malcolm X College, and the South Side meeting was held Jan. 16 at Third Baptist Church in the Washington Heights neighborhood.

Chicago residents can buy shares for as little as $250 or as much as $25,000, and they can buy as many shares as they want. There are no credit score requirements, and past felony convictions aren’t a barrier, either. However, while elected officials touted the deal as a major opportunity for minorities, especially Black Chicagoans, Loop Capital officials said that they won’t have any way to verify whether the investors are minorities and/or women.

Bally’s Chicago operates out of a temporary site at Medinah Temple, in the city’s River North neighborhood. The more permanent location, which will include a casino, hotel and music venue, will be built at the former site of Tribune Publishing’s Freedom Center printing plant farther west.

The Black Caucus is made up of all the Black aldermen on the City Council. While the group doesn’t always vote as a bloc, it often votes together on issues relevant to majority-Black communities. Notably, it pushed to get the minority investors provision. Several West Side Black Caucus members attended the Malcolm X College meeting, but most didn’t stay all the way through.

Conyears-Ervin, who is Black, is a longtime ally of the group, and she is married to the former group chair, Ald. Jason Ervin, 28th Ward, who chairs the City Council’s Committee on Budget & Government Operations.

The Malcolm X College auditorium gradually filled with a crowd that mostly came from Chicago’s West Side neighborhoods. (Photo by Igor Studenkov/for Chronicle Media)

Under the deal, investors can buy four types of shares — one that costs $25,000, one that costs $5,000, one that costs $2,500 and one that costs $250. All shares are worth $25,000. The difference with the latter three is that they come with attributable subordinated loans. In other words, the profits would be used to pay off the difference between what the shares are worth and what the investors paid for them. So, for example, investors who buy one $250 share would see the first $24,750 in profits automatically used to repay the loan, and only then would they start getting profit shares.

Sidney Dillard, head of Loop Capital’s corporate investment banking division, explained that this was done to make the public offering accessible to less well-off investors, even if it means those investors would need to wait longer to get a return on their investment. She emphasized that there is no way to pay off the loan ahead of time, but since the repayment gets deducted from the proceeds automatically, they don’t have to worry about having the money to repay it, either.

Ald. Walter Burnett, 27th Ward, whose ward includes both Malcolm X College and the future Bally’s Chicago permanent site, encouraged the attendees to invest.

“I don’t think we’ve ever had an opportunity like this in the City of Chicago before,” he said. “Thank you, Bally’s, for keeping your commitment to the City of Chicago, to the minorities in the City of Chicago, to give us an opportunity to have some ownership.”

Conyears Ervin said she was pleased with the turnout, especially since the workshop was pulled together on the two days’ notice. She noted that when Illinois legalized recreational cannabis, several well-connected companies snapped up the dispensary and cultivation licenses, leaving Black-owned companies trying to catch up.

“This project will affect our community, and we ought to have right to invest in it, if we choose,” Conyears Ervin said.

Chicago City Treasurer Melissa Conyears Ervin addresses the crowd at Malcolm X College. (Photo by Igor Studenkov/for Chronicle Media)

But she also warned attendees that this is a long-term investment, so residents can’t simply withdraw money whenever they feel like it, and it would take a few years before even the investors who get the full $25,000 shares would see any profit.

Dillard said that the shareholders won’t get any disbursements until every part of the project, including the hotel, is up and running — which, she said, is currently expected to happen sometime in the fall of 2027. She also said that this assumes the casino does make profit. But Dillard also said that, under the terms of the agreement, all investors have to get the profits at once, so it’s in Bally’s best interest to achieve profitability as soon as possible.

Attendees at the Malcolm X event were asked to submit their questions on slips of paper. Dillard also took some questions from residents after the event concluded.

Sidney Dillard addresses the crowd at Malcolm X College. (Photo by Igor Studenkov/for Chronicle Media)

Many of the questions had to do with the particulars of the loan, such as what the interest rate was (11 percent) and whether there are any additional fees (only whatever banks may charge for processing large transactions). When asked what would happen if the full-fledged casino doesn’t get built, or if it would never turn profits, Dillard said that, while the investors wouldn’t get anything back, they wouldn’t lose anything beyond what they put in.

She added that she believed that the full-fledged casino is more likely to make profit, pointing to more amenities, such as the larger size, more parking and the fact that, unlike the temporary casino, it will have poker tables.

When asked whether multiple people could pool together money to buy shares, Dillard said that “you gotta create some type of (Limited Liability Company), which would be a vehicle through which the investment would be made.”

When asked what would happen if Bally’s can’t sell the 25 percent of shares to women and minorities, she said that, under the contract, the casino needs to make “the best effort.” But while answering another question, Dillard revealed that the “minority/women-owned” aspect of the shares will operate on the honor system.

“It’s minorities and women, and we won’t come to your house and check if you are, that’s something you attest to,” she said. “It’s self-reporting, it’s not something we check for, because there’s not really a way for us to do.”

For more information, visit ballyschicagoinvest.com