Pensions still under pressure despite good news in 2021 report

By Jerry Nowicki Capitol News Illinois — December 9, 2021

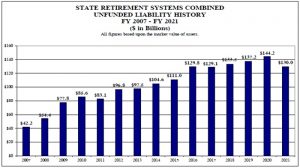

A graphic from the latest Commission on Government Forecasting and Accountability report on the state’s pension system shows the pension funds’ unfunded liabilities over time. (cgfa.ilga.gov)

SPRINGFIELD – The state saw its unfunded pension liability decrease in fiscal year 2021 for the first time in four years, due in large part to investment returns exceeding 20 percent, according to a new report from the Commission on Government Forecasting and Accountability.

Measuring by the current-day values of the pension fund assets, unfunded liabilities —or the amount of debt the state pension funds owe that they can’t afford to pay —dropped by nearly 10 percent, to $130 billion in FY 2021 from $144 billion in the previous fiscal year. That put the state’s five pension funds at 46.5 percent funded, up from 39 percent the previous year.

It’s the best funding ratio since 2008 and only the third decrease to unfunded liabilities in the last 15 years, the last occurring in FY 2017 at 0.5 percent, the other in FY 2011 at 2.9 percent. Otherwise, unfunded liabilities have risen annually from $42.2 billion in 2007.

But the report also noted that not much has changed to alleviate the underlying financial pressures that have caused unfunded liabilities to triple since the financial crisis of 2007-2008, meaning the good financial news was more anomaly than trend.

The returns of 22.9-25.2 percent for FY 2021, which ended June 30, far exceeded the anticipated 6.5 percent to 7 percent returns, according to the report.

Aside from the good investment news, the report was substantially similar to countless other pension reports in recent years, particularly because it once again called on the state to revamp the much-maligned 1994 “Edgar Ramp” plan for paying down pension debt.

That’s the name commonly used to refer to Public Act 88-0593, or the state’s 50-year plan to bring the its five pension funds to 90 percent funded by 2045.

The actual target for that ramp should be a 100 percent-funded pension system within the next 25 years or preferably sooner, according to a letter attached to the COGFA report from its actuary, Segal Consulting.

The letter also faulted the Edgar Ramp for “backloading” pension payments, providing for smaller contributions in the early years leading to the current reality which sees 20 percent of the state’s discretionary spending going to pension payments each year. It also highlighted other times the pension system was shortchanged, including during the tenure of former Gov. Rod Blagojevich.

Only after the target is increased to 100 percent, the report noted, would the state begin to see sustained reductions to its unfunded pension liabilities.

“(T)he funding plan under (Public Act) 88-0593 produces employer (State) contributions that are actuarially insufficient, meaning if all other actuarial assumptions are met, unfunded liabilities will still increase due to the State contributing an amount that is not sufficient to stop the growth in the unfunded liability,” according to the report.

But increasing pension payments is easier said than done, Alexis Sturm, director of the Governor’s Office of Management and Budget, said in a letter accompanying the report.

She was unavailable for a phone call Thursday, Dec. 9, but her letter to COGFA’s co-chairs said consideration of changes to the current 90 percent target “needs to be reviewed carefully within the context of the impact on the state’s budget.”

The $8.6 billion pension payment in FY 2021 was 20 percent of the state’s $42.9 billion General Revenue Fund budget, and pensions are routinely the state’s largest GRF expense outside of K-12 education. In fiscal year 2022, COGFA estimated the GRF payment at $9.4 billion, or over 21 percent of the operating budget.

FY 2023’s Edgar Ramp-mandated GRF payment is estimated at more than $9.6 billion, or nearly $10.8 billion including other state funds.

But, according to the report, if the state wants to contribute at a rate approved by actuaries, it will need to contribute nearly $14.9 billion in FY 2023, which begins July 1, or 38 percent higher than what is provided for via the Edgar Ramp.

“An increase to the goal would result in higher payments, but eventually lead to a reduction in the unfunded liabilities in the systems,” Sturm wrote. “Given the current fiscal pressures facing the state, this too is inadvisable to consider until Illinois can eliminate the unpaid bill backlog, borrowings undertaken to pay off the debts remaining from the budget impasse and the COVID-driven recession and address the underlying structural deficit.”

The backlog currently sits at about $4.8 billion, according to the website maintained by Illinois Comptroller Susana Mendoza, who said in a public appearance this week that the oldest unpaid voucher was 21 days old.

Still, the 90 percent goal, Sturm said, is “reasonable and achievable,” given the circumstances. Gov. J.B. Pritzker’s administration has fully funded the pension system at Edgar Ramp levels in each of his first three years, although he briefly considered lowering the payment in his first year before quickly dropping the plan.

In their letter to COGFA’s director, leaders at the state’s “big three” pension funds — the State Universities Retirement System, State Employees’ Retirement System and Teachers’ Retirement System — all also endorsed the 100 percent funding target and shorter ramps to full funding.

“Earlier funding, in addition to a targeted funding ratio of 100 percent, would make the retirement systems more secure and would substantially reduce financing costs due to interest accruing on the unfunded liability, the primary driver of the state contribution requirements,” the leaders of the pension systems wrote.

The report also noted that a pension buyout program initiated in 2018 and extended for three years by the General Assembly under Pritzker created a $213 million reduction in unfunded liability for FY 2021.

jnowicki@capitolnewsillinois.com