Illinois Republicans unite against tax shift

By Kevin Beese Staff reporter — March 5, 2019

State Rep. Avery Bourne (R-Raymond) said there are not enough rich people in Illinois to pay a graduated income tax for all of Gov. J.B. Pritzker’s promises.

Illinois House Republicans are united in opposition to Gov. J.B. Pritzker’s graduated income tax.

State Rep. Grant Wehrli of Naperville said the governor has to release his planned tax rates so that people can see just what the impact will be on their families.

“Show your work,” Wehrli said about the governor’s plan at a Feb. 27 Republican press conference in Springfield. “We need to see some data.”

What they have seen so far has been a turn-off, according to House Republicans.

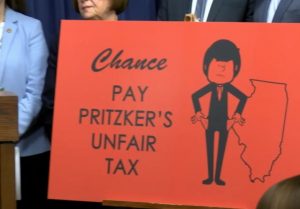

State Rep. Avery Bourne of Raymond said that House Resolution 153 states her Republican colleagues’ united opposition to a proposed graduated income tax, a mechanism they called an “unfair tax.”

“Illinois cannot afford another income tax increase and we cannot afford a system that allows politicians to play with rates and brackets just to fill budget holes,” said Bourne, a chief co-sponsor of the resolution. “A graduated income tax will inevitably bring a tax increase on a majority of Illinoisans and will hurt small businesses — making us even less competitive with our surrounding states. I’m proud to stand in opposition to Governor Pritzker’s proposed tax increase.”

State Rep. Avery Bourne (R-Raymond) said there are not enough rich people in Illinois to pay a graduated income tax for all of Gov. J.B. Pritzker’s promises.

In his Budget Address, Pritzker called for the passage of a progressive income tax to fund state government and help pay for many of his new spending proposals. The governor has yet to provide details on what the tax rates and tax brackets would look like.

“We’ve heard a lot of promises about what the tax increases will look like, yet we haven’t seen any tax brackets,” Bourne said. “My guess is that’s because Democrats know they can’t pay for the billions of dollars in promised spending without hitting the middle class. There simply aren’t enough rich people in Illinois to pay for all of the Pritzker promises and they know that.”

Last year, a House Democrat sponsored a bill, which sought to impose a graduated income tax. Under the plan, the non-partisan Commission on Government Forecasting and Accountability revealed that 77 percent of Illinois taxpayers would see an increase in their income tax liability for a total of more than $5.2 billion in new taxes, Bourne said.

“This graduated income tax proposal will punish hard-working families and small businesses that make up a majority of the tax base in Illinois,” Bourne said. “There is nothing fair in making average Illinoisans pay for the shortcomings of a legislature that has created a tax-and-spend paradigm that is unsustainable.”

Wehrli said HR 153, which opposes moving Illinois from a flat income tax to a graduated income tax, was filed Feb. 27 with all 44 House Republicans as sponsors.

The Naperville Republican said that during his budget speech the governor said that only the richest Illinoisans would pay more and pointed to Wisconsin and Iowa as possible models. Wehrli said that according to the Illinois Policy Institute, those models would raise taxes on anyone earning more than $26,100 (Wisconsin rates) or $46,500 (Iowa rates).

“We have yet to hear the Democrats’ definition of ‘richest Illinoisans,’” Wehrli said. “They’re not talking because they know that in the end, the middle class will have to pay more. They know that there simply aren’t enough wealthy people to generate the kind of revenue they need to quench their insatiable appetite for spending.”

Wehrli explained that Illinois already has one of the highest combined tax burdens in the United States, and said if Democrats want to raise taxes even further through a graduated income tax, they would have to pass the legislation themselves so that they alone would be responsible for the damage inflicted upon the middle class.

“The Democrats and Governor Pritzker are yet again proposing an intellectually lazy solution to a very serious fiscal problem,” Wehrli said. “We should be working collaboratively to grow the economy and create new revenue through job growth, but instead, the majority party just wants to continually look for more ways to raise taxes.”

Like us and follow us on Facebook